UK No Fault Claims and Your Car Insurance

Let's clear up a common myth right away: a 'no fault' claim doesn't mean blame is ignored. In the UK, it simply means your insurer can recover every penny of the claim's cost from the at-fault driver's insurance company. The entire process hinges on one critical factor: proving it.

What No Fault Claims Really Mean for UK Drivers

The term "no fault claim" is easily one of the most misunderstood concepts in car insurance. Many drivers hear it and assume it means no one is held responsible, or that making such a claim won't affect their record. This couldn't be further from the truth, and the distinction has serious financial implications for everyone.

Think of it like this: your neighbour is playing cricket in their garden, and a stray ball smashes through your kitchen window. It’s clearly their fault. While their home insurance will end up paying for the repair, you are the one who has to report it to your own insurer first. The same principle applies on the road.

A no fault claim is simply one where you are not to blame for an accident, and your insurer successfully claws back all the costs from the liable party's insurance provider. This includes everything from repairs and courtesy cars to any other expenses.

The Myth of No Consequences

The idea that "no fault" means "no consequences" is a dangerous misconception. Every single incident, regardless of who is to blame, introduces risk and administrative costs into the insurance system. Insurers track these events closely because they build a bigger picture of your overall risk profile.

The Claims and Underwriting Exchange (CUE) database holds records of over 34 million motor insurance claims, and that includes those classified as no fault. These records typically stick around for up to six years.

Even if you’re not at fault, the mere fact you were involved in an incident can lead to a slight increase in your premium. On average, a non-fault accident can raise insurance costs by around £120 annually. This happens because, from an insurer's perspective, a history of claims—even blameless ones—can suggest you drive in higher-risk areas or at peak times, making future incidents statistically more likely.

The core takeaway is this: proving you were not at fault is the single most important factor in protecting your premium and No Claims Discount. The burden of proof rests on establishing the other party's liability beyond doubt.

The Cost to the Industry and You

When no fault claims can't be proven definitively, the costs ripple outwards. Insurers can get tangled up in lengthy disputes, or they might have to absorb costs they simply can't recover. These expenses don't just disappear; they get factored into the overall cost of providing insurance for everyone.

What's more, unclear liability opens the door to insurance fraud. Dishonest individuals might try to exploit an ambiguous situation, leading to inflated or entirely fabricated claims. This kind of activity is a multi-billion-pound problem for the industry.

Ultimately, these costs are passed down to all policyholders through higher annual premiums. Every driver pays a price for unproven claims and fraudulent schemes. That’s why providing clear, irrefutable evidence isn’t just about protecting your own record; it's about contributing to a fairer, more affordable insurance system for everyone. Understanding what happens when an insurance company refuses to pay a claim can provide valuable insight into the importance of solid proof.

Why Proving Fault Is Central to UK Car Insurance

Unlike some countries with pure 'no-fault' systems, where each insurer simply pays for their own customer's damages, British law is built on a foundation of liability. It’s a simple but critical principle: for a claim to be paid, someone has to be legally responsible for what happened. This isn't just a modern insurance quirk; it's a legal cornerstone with deep historical roots.

This system was really shaped by necessity. Before modern, compulsory insurance became law, accident victims often faced financial ruin. If they couldn't definitively prove another party was negligent, they were left with nothing to cover their injuries or losses. This created a legal landscape where the burden of proof was absolutely everything.

The history of UK road traffic law is scattered with cases that highlight these early struggles. Take the notable 1975 case involving a young boy, Clifford Snelling, who was severely injured after being hit by a car. Despite his life-altering injuries, his family received no compensation. Why? Because under the legal framework at the time, no specific fault could be legally pinned on the motorist. You can read more about the historical context of UK no-fault compensation on cambridge.org.

The Road Traffic Act and the Burden of Proof

Cases like Snelling's hammered home the need for a more structured system, eventually leading to legislation like the Road Traffic Act . This was a pivotal law that made third-party insurance compulsory for every single driver. Its main purpose was to guarantee that a fund would always be there to compensate accident victims.

But the Act didn't get rid of the need to establish fault. In fact, it reinforced it. The law mandates that drivers are insured to cover the damage they might cause to other people. This structure puts the concept of liability right at the heart of every claim.

This is exactly why a solid trail of evidence is so crucial. Without it, insurers can't figure out who is liable, and the whole claims process can grind to a halt or end in a stalemate. When that happens, costs are often split, which ends up hitting both parties' premiums.

The legal framework in the UK is clear: for someone to be compensated, someone else must be proven legally responsible. This principle is why the term 'no fault claim' simply refers to the outcome, not the absence of blame.

The Impact on the Wider Insurance Industry

This emphasis on provability does more than just settle individual claims; it also acts as a vital defence against insurance fraud. When liability is murky, it creates openings for dishonest claims, like the 'crash for cash' schemes where accidents are deliberately staged.

These fraudulent activities aren't victimless crimes. They create a massive financial drain on the insurance industry, with costs estimated in the billions of pounds every year. Inevitably, insurers have to pass these losses on to all policyholders through higher premiums for everyone.

So, your ability to prove you weren't at fault does three critical things:

- It protects your No Claims Discount by making sure your insurer can get all their costs back.

- It helps combat fraud by leaving no room for dishonest parties to exploit the situation.

- It contributes to lower premiums for everyone by keeping fraudulent costs out of the system.

Ultimately, every piece of evidence you gather—from dashcam footage to witness statements—strengthens this fault-based system. It ensures a fairer process for you and for the entire pool of UK drivers.

How to Build an Unshakeable No Fault Claim

When an accident happens, the moments immediately following are chaotic. It's stressful, confusing, and your adrenaline is pumping. But what you do in those crucial minutes can be the difference between a smooth, straightforward no fault claim and a drawn-out, costly dispute. Let's move from theory to practice; this is your playbook for building a case that leaves no room for doubt.

The aim here is simple: prove beyond question that the other party was at fault. A provable claim doesn't just protect your hard-earned No Claims Discount; it’s also a powerful defence against potential insurance fraud—a problem that quietly adds a chunk to everyone’s premiums. An unsubstantiated claim, on the other hand, can quickly spiral into a messy "he said, she said" scenario.

Your Immediate Post-Accident Checklist

The evidence you gather at the scene is the bedrock of your claim. Your insurer wasn't there to see what happened, so it's your job to paint them a crystal-clear picture. The key is to stay calm and methodically work through these steps to create an undeniable record of events.

- Prioritise Safety First: Before you do anything else, check if anyone is injured and move to a safe place if you can. If someone is hurt or the road is blocked, call 999 immediately.

- Capture Photographic Evidence: Your phone is your best tool here. Take photos and videos from every angle imaginable. Get close-ups of the damage to all vehicles, but also capture wider shots of the scene, vehicle positions, road markings, and any relevant traffic signs.

- Exchange Details Correctly: You need to swap the essentials with the other driver: their name, address, phone number, and insurance details. Crucially, avoid apologising or admitting any fault. Even a simple "sorry" can be misinterpreted and used against you later.

- Gather Witness Information: Independent witnesses are gold dust. If anyone saw the accident, politely ask for their name and contact number. Their impartial account could be the single thing that swings a disputed claim in your favour.

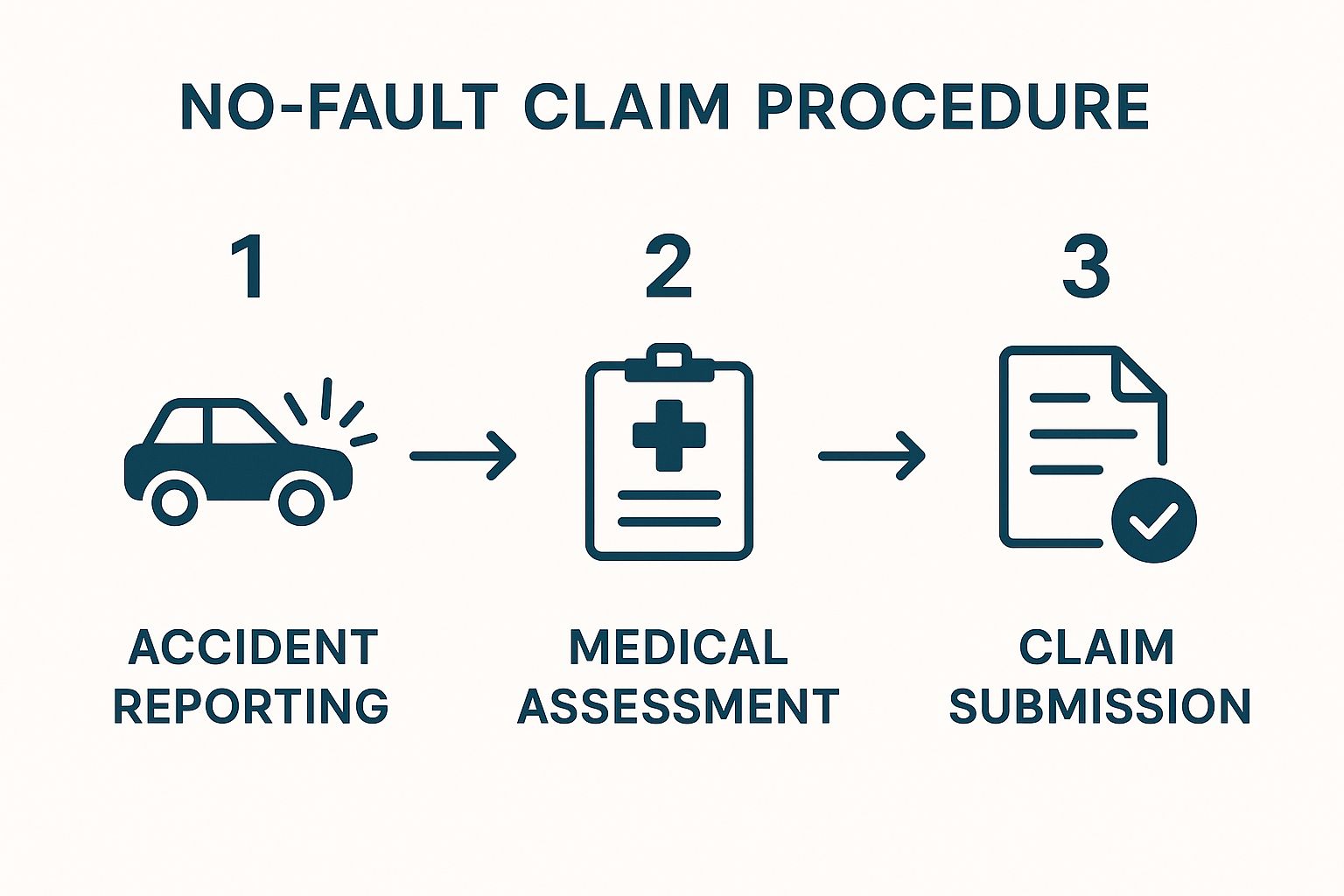

As the image shows, the process is a logical sequence. It starts with reporting the incident right away and ends with the formal submission of your claim, backed by solid proof.

The Power of Provability in No Fault Claims

A well-documented claim just makes everything smoother. It removes all the grey areas and makes it incredibly difficult for the other party to argue about who was liable. More than that, it slams the door on opportunities for fraud, like someone trying to exaggerate their claim or shift the blame onto you.

The strength of your no fault claim is directly proportional to the quality of your evidence. In a system built on liability, verifiable proof is your most powerful tool.

This is exactly where technology like dashcams becomes indispensable. That unblinking footage capturing the event as it happened is often the most compelling piece of evidence you can possibly provide. It can instantly put an end to arguments over who ran a red light, who was in the wrong lane, or who made a sudden, unexpected manoeuvre.

By presenting verified evidence, you’re not just helping yourself. You’re contributing to a fairer system for everyone by fighting fraud before it even happens.

Evidence Showdown: Provable vs Unprovable Claim Outcomes

The difference between a claim backed by solid proof and one built on shaky ground is stark. The table below illustrates the very real financial consequences of being prepared versus being caught out.

| Aspect | Well-Documented (Provable) Claim | Poorly-Documented (Unprovable) Claim |

|---|---|---|

| Evidence Provided | Clear dashcam footage, multiple photos, independent witness details, and detailed notes. | Vague personal account, a few blurry photos, no witness information. |

| Liability Outcome | The other party's fault is clearly established; your insurer recovers 100% of its costs. | Liability is disputed or split 50/50 ; costs are not fully recovered. |

| No Claims Discount | Your No Claims Discount is protected and remains intact at renewal. | Your No Claims Discount is likely reduced or lost, leading to higher future premiums. |

| Excess Payment | Your policy excess is paid initially but is fully refunded by your insurer upon cost recovery. | Your excess is unlikely to be refunded as your insurer cannot recover its full outlay. |

| Financial Impact | Minimal impact. Your premium may see a small rise, but your NCD is secure. | Significant impact. Loss of NCD and a fault claim on your record lead to major premium hikes. |

Ultimately, taking these steps at the scene transforms you from a passive victim of circumstance into an active participant in protecting your financial standing. By building a robust, evidence-backed no fault claim, you ensure fairness for yourself and help uphold the integrity of the insurance system for everyone.

The Hidden Costs of UK Insurance Fraud

Many people think of insurance fraud as a victimless crime, a clever way to get one over on a big, faceless corporation. The reality? That perception is dangerously wrong. Fraud is a multi-billion-pound problem in the UK, and its costs are passed directly onto every honest driver through higher annual premiums.

When you make a no fault claim, you rightly expect the process to be fair and based on the facts of what happened. But the entire system is under constant pressure from fraudulent activities that inflate costs for everyone and create a culture of suspicion. This isn't just some minor inconvenience; it's a huge financial drain on the insurance industry and, by extension, your wallet.

The Anatomy of a Fraudulent Claim

Insurance fraud isn't a single activity. It takes many forms, ranging from subtle exaggerations all the way to highly organised criminal conspiracies. Each type adds another layer of cost that insurers have to factor in when they calculate premiums for all their customers.

A few of the most common schemes include:

- 'Crash for Cash' Schemes: These are premeditated collisions where fraudsters deliberately cause an accident with an innocent motorist. A classic example is slamming on the brakes for no reason, all to stage a crash and make a bogus claim.

- Exaggerated Claims: This is where someone embellishes the extent of vehicle damage, tries to claim for pre-existing issues, or inflates the severity of personal injuries like whiplash.

- Phantom Passengers: In some cases, fraudsters will claim for injuries to passengers who weren't even in the car when the incident happened.

Together, these schemes cost the industry an astronomical amount. The Association of British Insurers (ABI) has previously estimated that undetected general insurance fraud costs over £2 billion a year. That figure translates directly to an extra £50 tacked onto the average household's annual insurance bill.

How Insurers Fight Back Against Fraud

In response to this growing threat, insurers are no longer just passive payers of claims. They've invested heavily in specialist teams and advanced systems designed to spot and investigate suspicious activity. It's a critical battlefront for keeping the cost of no fault claims manageable for everyone.

Insurance fraud isn't a victimless act against a large company. It's a direct tax on every honest policyholder, driving up the cost of essential cover for millions of people across the UK.

Insurers now use a whole range of methods to root out dishonest claims. Sophisticated data analysis tools can flag patterns that suggest fraudulent behaviour, like multiple claims coming from the same person or address. From there, dedicated fraud investigation teams take over, scrutinising every single detail of a suspicious claim.

This is where the integrity of your information becomes so important. When you provide clear, honest, and verifiable evidence for your no fault claim, you’re not just protecting your own interests. You're actively helping your insurer separate your legitimate claim from the thousands of fraudulent ones they deal with each year. To get a better sense of the scale of the problem, you can explore the economic impact of insurance fraud and see just how these costs add up.

Your Role in Maintaining a Fair System

Ultimately, the fight against insurance fraud is a collective effort. Your duty to provide honest and accurate information is directly linked to the bigger goal of keeping insurance affordable for all drivers. By building a solid, provable claim, you help the system work as it should—ensuring legitimate claims get paid promptly while fraudulent ones are stopped in their tracks.

Every fabricated claim that gets paid is a cost eventually shared among all of us. When you understand that connection, it becomes clear that preventing fraud isn't just the insurer's job. It's a shared responsibility that benefits every single driver on the road.

How Claim Payouts Drive Up Your Annual Premium

Ever opened your car insurance renewal letter and felt that familiar sting of confusion? The price has gone up, again, even though you haven’t made a claim all year. It’s a frustration shared by millions of drivers, and the real reason often has little to do with your personal driving habits.

The truth is, your premium is a small slice of a much larger pie. It reflects the colossal, industry-wide costs that insurers have to cover every single day.

Every payout, from a tiny scuff in a car park to a major multi-vehicle pile-up, adds to a massive pool of expenses. This pool isn’t just filled by repair bills; it’s swollen by complex legal battles, administrative overheads, and the constant fight against organised fraud. And ultimately, this entire financial ecosystem is funded by one source: the premiums paid by policyholders like you.

Even when you’re involved in a clear-cut no fault claim , the process is far from free. Your insurer still has to pour resources into managing the claim, getting your car repaired, and then chasing the at-fault driver's insurance company to get that money back. That recovery process can drag on, adding yet another layer of operational cost to the system.

The Soaring Cost of Keeping Cars on the Road

Modern cars are technological marvels, packed with features that keep us safer than ever. But all that progress comes with a hefty price tag.

A cracked bumper is no longer just a piece of plastic. These days, it’s a hub for sensors, cameras, and delicate electronics that are eye-wateringly expensive to repair or replace. A simple bump can easily lead to a four-figure bill.

This surge in repair costs is one of the biggest factors pushing premiums skyward. When the average cost per claim creeps up, insurers have no choice but to adjust their pricing. It’s a simple economic reality that hits every driver’s policy.

The price you pay for your policy isn't just about your individual risk. It’s a share of the collective cost of accidents, repairs, legal fees, and fraud across the entire country.

The numbers don’t lie. Recent industry data shows a clear and worrying upward trend. In the UK, between 2019 and 2023, the total cost of bodily injury claims climbed by 7% to nearly £2.9 billion . More starkly, accidental damage claims rocketed up by 52% to around £2.4 billion , while property damage claims jumped by 44% to £2.1 billion . You can dig deeper into these motor insurance claim trends on fca.org.uk.

Why Provability and Fraud Prevention Matter to Everyone

This is where the idea of a 'provable' claim becomes so important for every single policyholder, not just those involved in an incident.

Every unproven or disputed claim adds to the collective financial burden. When liability is murky, insurers can get stuck in expensive legal wrangles or end up splitting the costs, meaning they never recover their full outlay.

These unrecovered losses don’t just disappear. They get absorbed back into the system and reappear in the form of higher premiums for everyone the following year. It’s the same story with fraud. Every bogus 'crash for cash' scheme or exaggerated injury claim that succeeds is another cost that honest drivers end up paying for.

By focusing on building an unshakeable, evidence-backed no fault claim, you’re doing more than just protecting your No Claims Discount. You’re helping to reduce the friction and financial leaks that drive up costs for the entire industry. And that, in turn, helps keep premiums more stable for all UK drivers.

Answering Your Questions About No Fault Claims

Navigating the aftermath of a road accident can feel overwhelming. Suddenly, you're dealing with unfamiliar terms and processes at every turn. Many drivers have practical questions about how no fault claims truly impact them, especially when it comes to their finances and driving record.

We’ve gathered the most common queries to give you clear, straightforward answers and cut through the industry jargon. Understanding these key points will help you handle the claims process with much more confidence.

Will a No Fault Claim Affect My No Claims Discount?

This is often the number one concern for drivers, and the answer hinges entirely on one thing: can your insurer prove the other party was 100% to blame?

If your insurer successfully recovers every penny of their costs from the at-fault party's insurance, your No Claims Discount (NCD) should remain perfectly intact at renewal. Simple as that.

However, if liability is disputed or the costs can't be fully recovered, it could impact your NCD. This is where a protected NCD can be a real lifeline, often allowing for one or two claims within a set period without losing your hard-earned discount. It's always a good idea to check your specific policy wording to be sure.

Why Do I Have to Pay My Excess if It Wasn’t My Fault?

It can feel deeply unfair to pay an excess when someone else caused the accident, but this is a standard step in the claims process. Think of the excess as your contribution to kick-start the repair and claims handling, allowing your insurer to act swiftly on your behalf.

Your insurer's primary goal is then to get this money back, along with all their other costs, from the responsible party's insurer. Once they're successful, your excess payment will be fully refunded to you. This recovery process can sometimes take several months, so a little patience is needed.

Remember, paying an excess is a procedural step, not an admission of fault. Its refund is directly tied to your insurer's ability to prove the other party was liable and recover all the costs.

How Long Will a No Fault Claim Stay on My Record?

In the UK, you generally need to declare any accident or claim—whether it was your fault or not—when applying for insurance for around five years . This information helps insurers build an accurate picture of your risk profile.

While a single, proven no fault claim is unlikely to cause a major premium hike, insurers do look at patterns. A history of multiple claims, even if you weren't to blame for any of them, can be seen as an indicator of higher risk.

Insurers might conclude that you frequently drive in high-risk areas or at peak times, making future incidents statistically more probable. This is one of the subtle ways even blameless accidents can be reflected in your future insurance quotes. The key is to minimise this risk by always providing watertight evidence, ensuring claims are correctly and quickly settled in your favour.

At Proova , we understand that proving what you own is the cornerstone of a fast and fair claims process. Our platform simplifies the verification of your belongings, creating an indisputable record that helps insurers settle claims quickly and fight fraud effectively. Protect your assets and ensure a smoother insurance experience by visiting https://www.proova.com.