UK Commercial Vehicle Liability Insurance Explained

Think of commercial vehicle liability insurance as your business's financial armour on the road. It’s the essential cover that shields your operations from the immense costs that come with accidents involving your vehicles, protecting you when you’re found legally responsible for injury to others or damage to their property.

This isn't just a good idea; it's a strict legal requirement.

The Foundation of Your Business Protection

Every business that uses vehicles on UK roads—whether it's a single van for local deliveries or a large fleet of lorries—operates with an inherent risk. An accident can happen in a split second but the financial fallout can last for years. This is where commercial vehicle liability insurance steps in, acting as a critical financial safety net.

It ensures that if one of your drivers is at fault, your business isn't left to face potentially ruinous legal fees and compensation claims alone.

At its core, this protection is all about responsibility. With commercial vehicles being such a vital part of UK business logistics, the law mandates this insurance to protect the public. At a minimum, it must cover third-party liability , ensuring victims of an accident are compensated for their injuries or property damage.

What Does Liability Cover?

At its heart, this insurance addresses two primary areas of risk, which are often bundled together under the liability umbrella.

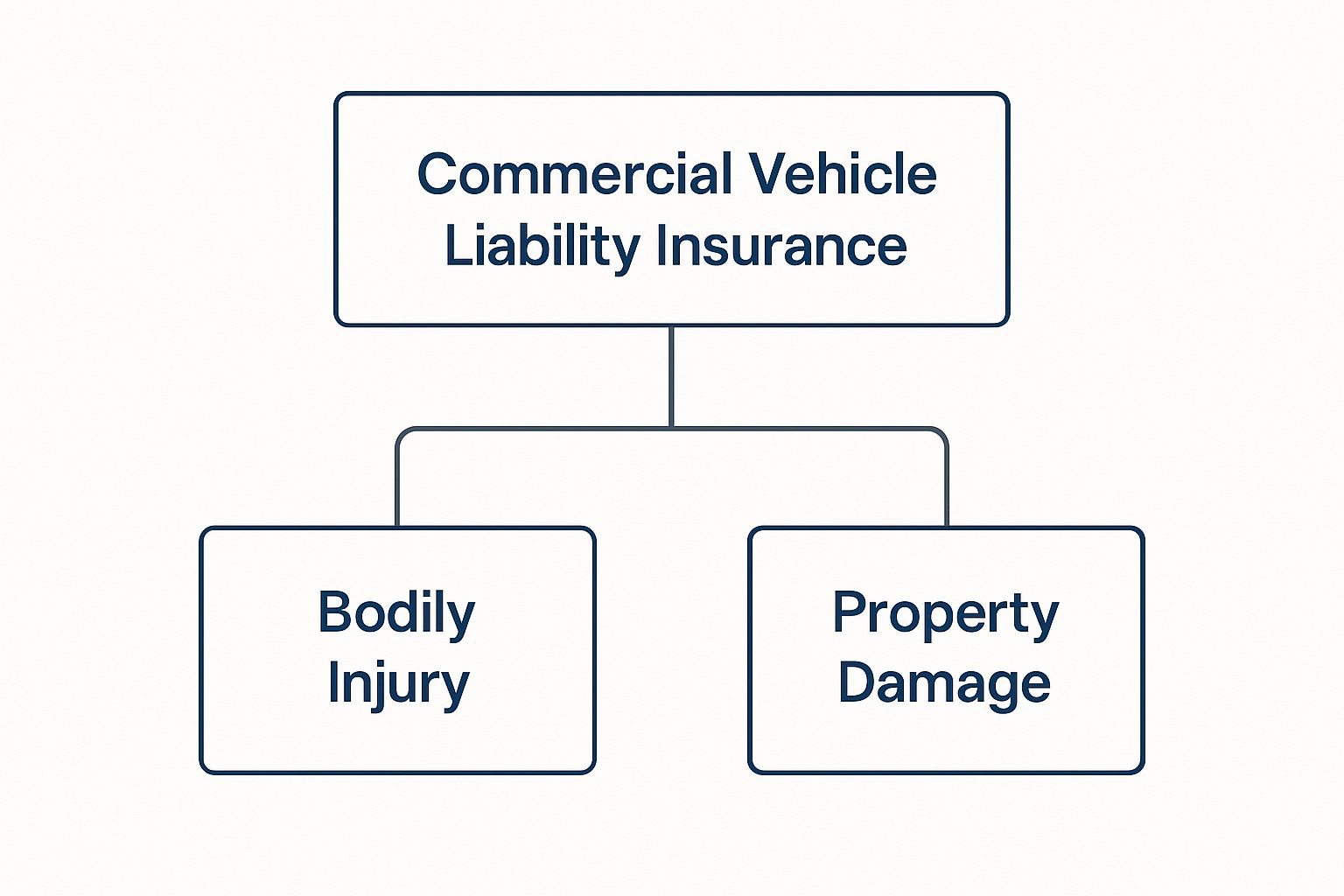

This infographic shows how commercial vehicle liability insurance branches into its two core components.

This visualisation clarifies that the policy is designed to handle both the human and material costs of an at-fault incident.

The two main pillars of liability coverage are:

- Bodily Injury: This covers the costs associated with injuries or death caused to another person. This can include everything from medical expenses and loss of income to legal fees.

- Property Damage: This addresses the cost of repairing or replacing another person’s property, such as their vehicle. It could also include things like walls, fences or buildings damaged in the incident.

To really get to grips with your policy, it's vital to get your head around understanding limitation of liability clauses , which define the maximum amount an insurer will pay out.

Beyond the Legal Minimum

While the law requires third-party only cover as a bare minimum, it’s rarely enough for most businesses. This basic level only covers the other party involved in an incident. It provides no protection for your own vehicle or driver, leaving your business assets dangerously exposed.

Relying solely on the minimum legal requirement is a significant gamble. One serious accident could result in the loss of a valuable vehicle and substantial operational disruption—costs that a more comprehensive policy would address.

That's why most businesses opt for higher levels of cover. The main options provide a much broader shield, protecting your own assets and offering far greater peace of mind.

Comparing Levels of Commercial Vehicle Cover

To make it clearer, here’s a straightforward breakdown of the three main types of commercial vehicle insurance you'll find in the UK.

| Type of Cover | What It Covers | Best For |

|---|---|---|

| Third Party Only | Covers injury to others and damage to their property. It does not cover your own vehicle or driver. | Businesses looking for the absolute legal minimum level of cover. |

| Third Party, Fire & Theft | Includes all third-party cover, plus protection if your vehicle is stolen or damaged by fire. | Businesses wanting a balance of affordability and protection for their assets. |

| Comprehensive | Covers everything above, plus damage to your own vehicle, even if the accident was your fault. | Businesses seeking the highest level of protection and financial security. |

Choosing the right level of commercial vehicle liability insurance isn't just about ticking a legal box. It's a fundamental business decision that safeguards your company's financial future.

Decoding the True Cost of Your Premiums

Many business owners get a bit of a shock when they see the cost of commercial vehicle liability insurance compared to their personal car policy. This isn't just an arbitrary price hike; it's a direct reflection of the much greater level of risk that insurers have to shoulder when they cover a business on the move. Once you understand the factors at play, the numbers start to make a lot more sense.

For a start, commercial vehicles live on the road. They clock up far more mileage and spend longer hours navigating everything from motorways to tight city centre streets than a typical family car. This constant presence naturally increases the chances of an incident. It’s a simple game of odds: more time on the road means more opportunities for something to go wrong.

Then there’s the nature of the work itself. A lorry loaded with valuable goods or a minibus full of passengers represents a massive potential liability in an accident, far beyond that of a personal vehicle. On top of that, the sheer size and weight of many commercial vehicles mean they can cause far more severe damage and injury, which often leads to larger and more complicated claims.

Economic Pressures on Your Policy

Beyond the day-to-day operational risks, there are wider economic forces that have a huge say in the premiums you pay. These are factors completely outside of your control, yet they can have a direct and significant impact on your insurance costs.

Inflation is one of the biggest culprits. As the cost of everything rises, so does the price of vehicle repairs—from parts and paint to the specialist labour needed to get a commercial vehicle back in service. Garages have to charge more to cover their own climbing expenses and these costs are ultimately passed on to insurers when claims are filed.

A dented bumper that might have cost £500 to repair a few years ago could now easily set an insurer back £800 or more. When you multiply that increase across thousands of claims, it forces insurers to adjust their premiums upwards just to stay afloat.

This is made worse by the ongoing disruptions in global supply chains. Getting hold of specific parts for commercial vehicles can be a slow and expensive process, leading to longer repair times. A vehicle that’s off the road isn’t earning money, which can lead to bigger business interruption claims and add yet another layer to the overall risk profile.

The Rising Tide of Insurance Costs

When you combine all these pressures, you can see a clear effect on the market. In fact, the UK commercial motor insurance market has seen rates climb by roughly 7-8% in recent times, a direct result of these escalating repair costs and economic headwinds. It’s a clear example of how external economic factors filter down and directly translate into higher premiums for business owners.

It’s this complex web of risk, usage and economic reality that shapes the final cost. Insurers aren't just covering a vehicle; they're underwriting the huge financial exposure that comes with its commercial operation, from potential medical bills for injured people to eye-watering legal fees and the cost of repairing someone else’s property.

While it’s important to understand what’s driving your premiums, it’s even more crucial to explore practical strategies to reduce truck insurance costs. By actively managing your risk profile through safe driving programmes, consistent vehicle maintenance and embracing new technologies, you can start to gain more control over these long-term expenses.

How to Navigate the Insurance Claims Process

When an incident happens on the road, the moments that follow are critical. A calm, decisive response can be the difference between a smooth claims process and a stressful, drawn-out dispute. Understanding the right steps protects your driver, your business and your commercial vehicle liability insurance record.

The first priority is always safety. The driver needs to stop the vehicle somewhere safe if possible, switch on the hazard lights and check for any injuries. If anyone is hurt or the road is blocked, calling the police and ambulance services immediately is non-negotiable.

Once the scene is secure, the focus has to shift to gathering accurate information. This isn't about pointing fingers or assigning blame; it's about creating a factual, objective record of what happened. A well-prepared driver knows exactly what details they need to support a future claim.

Actions at the Scene

At the scene of an incident, every little detail matters. The most important rule? A driver should never admit fault or liability. Doing so can seriously complicate the insurance process down the line. Instead, their job is to focus on collecting the facts.

Here's the key information they need to gather:

- Other Party Details : The full name, address, contact number and insurance details of any other drivers involved.

- Vehicle Information : The make, model, colour and registration number for all vehicles.

- Witness Contacts : The names and contact details of any independent witnesses who saw what happened.

- Photographic Evidence : Clear pictures of the scene from various angles, showing vehicle positions, the extent of the damage, road conditions and any relevant signs or markings.

This evidence forms the foundation of your claim. It gives your insurer a clear, unbiased picture of the circumstances surrounding the incident, right from the start.

Notifying Your Insurer

The next step is to report the incident to your insurance provider as soon as it’s safe and practical to do so. Most policies have a specific timeframe for reporting and missing this deadline could jeopardise your cover. When you call, give them all the information gathered at the scene.

From there, your insurer will appoint a loss adjuster or a claims handler. Their job is to investigate the incident, assess the damage and determine liability based on all the evidence. They'll review the information you’ve provided, speak to the other parties and might need to inspect the vehicles involved.

Be prepared for a thorough investigation. The insurer’s goal isn't to catch you out; it's to establish the facts so they can process the claim correctly. Cooperating fully and providing truthful information is the fastest route to a resolution.

Delays in this process can be incredibly costly for everyone. To combat this, many brokers and insurers are now using technology to verify evidence quickly and accurately. In fact, understanding how technology helps brokers speed up claim resolutions by 70% really highlights the impact of having clear, verifiable proof from the outset.

Navigating the claims process for your commercial vehicle liability insurance requires a cool head and a methodical approach. By training your drivers to act calmly, gather precise information and report promptly, you empower your business to handle unexpected events effectively. It ensures a much smoother path to resolution and minimises disruption to your operations.

The Hidden Costs of Insurance Fraud

It’s easy to think of insurance fraud as a victimless crime, a clever trick played on a faceless corporation. But that couldn't be further from the truth. In reality, it’s a systemic problem that sends financial ripples across the entire industry, with the final bill landing squarely on the desks of honest business owners.

Every single fraudulent claim that gets paid out adds to a pool of losses that insurers have to recover. And how do they recover it? Through higher premiums for everyone. This isn’t just a minor annoyance; deception has become a multi-billion-pound industry in itself and the cost is borne by us all.

The methods are varied, ranging from organised criminal gangs staging accidents to individuals simply exaggerating the extent of genuine damage. But the outcome is always the same. Honest policyholders end up paying more for their commercial vehicle liability insurance to cover the costs created by the dishonest few.

This issue goes far beyond a few dodgy whiplash claims. It’s a complex web of deceit that directly threatens the sustainability of the insurance market. When insurers can't trust the information they're given, they have no choice but to build a bigger risk margin into their pricing, which inevitably drives up costs for every single business and ultimately every consumer.

Common Fraudulent Schemes

Insurance fraud takes many forms, some blatantly criminal and others deceptively subtle. Each one creates a financial burden that is ultimately passed on to every business needing commercial vehicle cover and every household.

One of the most notorious scams is 'crash for cash' . These are deliberately staged accidents where fraudsters, often working in organised groups, cause a collision with an innocent driver. They might slam on the brakes for no reason or flash their lights to let someone out of a junction, only to accelerate into them. The goal is to pin the blame on the innocent party and then submit massively inflated claims for vehicle damage, personal injury and even fake car hire costs.

The Insurance Fraud Bureau (IFB) estimates that 'crash for cash' scams alone cost the UK economy a staggering £392 million every year. This isn't just an industry problem; it's a direct tax on every honest motorist and business out there.

Another common tactic is claim exaggeration . This happens after a genuine incident but the policyholder dishonestly inflates the value of their loss. For a commercial vehicle, this could mean claiming for pre-existing damage as if it happened in the accident, or adding phantom high-value items to a list of goods damaged in transit.

Finally, there’s application dishonesty . This is where someone provides false information when taking out a policy to get a lower premium. It could be misrepresenting a driver’s claims history, understating the vehicle’s annual mileage or not declaring what the vehicle is really used for. It might seem like a small white lie but it’s a form of fraud that distorts the entire risk pool and stops insurers from pricing their policies accurately.

The Financial Burden on Your Business

The collective cost of all this fraudulent activity is massive. When insurers have to pay out on thousands of deceptive claims, they have no choice but to raise premiums for everyone just to stay afloat. This means your business, which operates honestly and invests in safe driving, is directly paying for the criminal actions of others. The cost of your commercial vehicle liability insurance is artificially inflated because of this widespread problem which affects the entire industry.

And it’s not just about rising premiums. Fraud clogs up the entire claims system, leading to much longer investigation times for legitimate incidents. A straightforward claim that should be settled in weeks can be delayed for months as insurers are forced to dedicate more resources to verifying every last detail. This can cause significant disruption for your business, keeping essential vehicles off the road for far longer than necessary.

Ultimately, insurance fraud undermines the very principle of insurance: a shared pot of money to help those who suffer a genuine, unexpected loss. Instead, it becomes a system where the honest majority pays a heavy price for the actions of a dishonest minority. To understand just how big this problem is, you can explore what insurance fraud really costs the industry and see its impact on businesses like yours.

This is exactly why the ability to prove the facts of a claim has become so critical. In a market plagued by dishonesty, verifiable evidence is the only reliable way to ensure a fair and efficient outcome, protecting your business from both false accusations and the rising costs they create for everyone.

Why Provability Is Your Strongest Defence

When an incident happens on the road, the story can get messy, fast. You’re often left dealing with conflicting accounts, exaggerated claims and sometimes, outright fraud. What starts as a straightforward event can quickly spiral into a costly, drawn-out dispute.

In this kind of environment, your strongest shield isn't just having insurance; it's having indisputable proof of what actually happened.

The answer is provability . It’s the power that comes from having a clear, objective and verifiable record of an incident. It cuts straight through the ‘he said, she said’ arguments that cloud so many claims, replacing confusion with cold, hard facts. When you can prove what happened, you control the narrative.

Modern technology makes this possible. Dashcams and telematics systems aren't just optional extras anymore; they're essential tools for managing risk. Think of them as an unbiased witness that records every moment, capturing the crucial details that determine who’s at fault and protecting your business from false accusations.

Cutting Through the Noise with Evidence

Insurance fraud is a massive, growing problem. When you’re up against it, authenticated evidence is your ultimate defence. A fraudulent claimant might spin a convincing story but it’s tough to argue with high-definition video footage that shows the real sequence of events.

Suddenly, provability becomes a powerful deterrent.

When a potential fraudster knows an incident was recorded, they’re far less likely to try a 'crash for cash' scam or inflate a minor knock into a major claim. It’s a proactive defence that can stop your business from ever becoming a target.

But this isn't just about fighting fraud. It also dramatically speeds up genuine claims. When your insurer gets immediate access to clear, verifiable evidence, they can establish liability in a fraction of the time. That means your vehicle gets repaired faster, disruption is minimised and legitimate third-party claims get settled without pointless delays.

Verifiable evidence transforms the claims process from a lengthy, painful investigation into a straightforward administrative task. It ensures that honest claims are paid promptly while fraudulent ones are stopped in their tracks, creating a fairer system for everyone.

This commitment to clarity doesn’t go unnoticed by insurers, either. By consistently providing clear, provable data, you show that your business is a well-managed, low-risk operation. You're actively helping them cut their own costs and exposure to fraud.

Building a Reputation as a Lower-Risk Client

Over time, this dedication to provability establishes you as a trusted partner. Insurers value clients who can give them a clear and objective account of incidents, as it slashes their investigative costs and helps them fight bogus payouts. This positive reputation can have a direct, beneficial impact on your commercial vehicle liability insurance premiums.

Investing in provability isn't just about winning individual claims; it's about future-proofing your business. It's a strategic move that delivers multiple returns:

- Reduced Fraud Risk: It deters criminals and exposes exaggerated claims.

- Faster Claims Resolution: It gets your vehicles back on the road sooner.

- Lower Administrative Burden: It simplifies the entire claims process.

- Enhanced Insurer Relationship: It builds trust and can lead to fairer premiums.

Ultimately, you’re shifting from a reactive position—defending yourself after an incident—to a proactive one. You're giving your business the tools to present an undeniable version of the truth. To see how this works in practice, you can learn about the power of verified evidence in fighting fraud before it happens and how it protects your bottom line.

The Real Risks of Being Underinsured

Cutting corners on your commercial vehicle liability insurance might feel like a savvy way to manage costs but it's a dangerous gamble. In reality, being underinsured is like driving blindfolded on a motorway; any short-term savings are completely dwarfed by the potential for a catastrophic outcome.

Operating with inadequate cover leaves your business wide open to crippling financial and legal consequences. Proper insurance isn’t just about ticking a legal box. It’s a fundamental pillar of risk management that ensures your business can actually survive a serious incident.

The scale of this problem is surprisingly large. Despite millions being paid out daily for liability claims, a worrying number of UK small and medium-sized businesses are running with insufficient cover, or even none at all. You can read more about the trends shaping the commercial motor insurance market on macbeths.co.uk.

The Financial Fallout of an At-Fault Accident

Picture this: one of your delivery vans is found responsible for a multi-vehicle pile-up causing serious injuries. The compensation claims that inevitably follow can be astronomical, quickly running into millions to cover medical costs, loss of earnings and long-term care for multiple people.

If your policy’s liability limit is too low to cover the total bill, the remaining debt doesn't just vanish. Your business becomes directly responsible for paying the difference. It's a debt that could easily push a thriving company into insolvency.

And the financial bleed doesn't stop there. You'll also be on the hook for substantial legal fees, court costs and the expense of hiring expert witnesses. Without the right commercial vehicle liability insurance, these costs come straight out of your business's revenue or assets.

Beyond Financial Ruin

The consequences of being underinsured stretch far beyond your bank account. The personal and professional stakes for you as a business owner or director are incredibly high.

An at-fault accident without proper insurance cover isn’t just a corporate problem. It can lead to personal liability for directors, putting personal assets like your home on the line to settle claims against the business.

In severe cases, the fallout can be even more drastic. The legal repercussions can include:

- Director Disqualification: If a court finds that directors acted negligently by knowingly operating without sufficient insurance, they can be banned from managing any company for years.

- Reputational Damage: An incident like this can completely destroy your company's reputation, making it next to impossible to secure new contracts or retain clients.

- Operational Collapse: The seizure of your assets to pay claims can grind your operations to a halt overnight, leading to a swift and irreversible business failure.

Choosing the right level of commercial vehicle liability insurance is one of the most critical decisions you'll make. It’s the shield that protects not only your business assets but your personal livelihood and professional future from the very real liabilities you face on the road every day.

Frequently Asked Questions

When you're sorting out insurance for your business vehicles, a few common questions always seem to pop up. Here are some straightforward answers to help clear things up and make sure you’ve got the right protection in place.

Does My Personal Car Insurance Cover Business Use?

In short, no. A standard personal car insurance policy is strictly for personal, social and commuting use. The moment you start using your vehicle for commercial activities—like making deliveries, transporting goods for a fee or carrying paying passengers—you've stepped outside its scope.

Relying on personal insurance for business use is a huge gamble. If you have an accident, your insurer will almost certainly refuse the claim, leaving you personally responsible for all the costs. That could put your home, savings and other personal assets on the line.

What Is The Difference Between Public And Commercial Vehicle Liability?

It’s easy to mix these two up but they cover very different risks.

Commercial vehicle liability is laser-focused. It specifically handles claims for injury or property damage caused by your business vehicles while they are being used for work.

Public liability insurance , on the other hand, is much broader. It protects your business against claims of injury or damage that happen as a result of your general business activities. For example, if a client trips over a cable in your office, that’s a public liability issue. But if your van scrapes another car in a client's car park, that’s a job for your commercial vehicle liability policy. Most businesses with a fleet need both to be fully protected.

A simple way to think about it: commercial vehicle liability covers your business on the move , while public liability covers it at a location . Both are vital for managing your overall risk.

How Can I Lower My Commercial Vehicle Insurance Premiums?

While premiums can feel like a fixed cost, there are several practical steps you can take to bring them down. Insurers are always looking for signs that a business takes risk management seriously and proving it can really pay off.

Here are a few of the most effective strategies:

- Install Telematics: These devices track driving habits like speed, acceleration and braking. The data gives you a clear picture of how your vehicles are being driven, helping you coach your team to be safer on the road.

- Maintain a Clean Claims History: Nothing speaks louder than a solid track record. A history with few or no at-fault claims is one of the most powerful ways to negotiate better rates.

- Fit Security Devices: Alarms, immobilisers and GPS trackers make your vehicles a less attractive target for thieves. This reduces the risk of a theft claim, which insurers will recognise in your premium.

- Use Verifiable Evidence: Dashcams are a game-changer. They provide clear, indisputable evidence of what really happened in an accident. This helps you shut down fraudulent "crash for cash" claims and proves to insurers that you're a transparent, low-risk client, which can lead to fairer premiums over time.

Managing risk and proving you own what you claim to own are fundamental to getting fair insurance terms. Proova offers a simple, powerful way to create a verifiable digital record of your business assets. This not only speeds up claims but also demonstrates your commitment to transparency from day one. Protect your business and make your insurance process smoother by visiting https://www.proova.com to learn more.