What Is Third Party Car Insurance UK Guide

Third party car insurance is the most basic level of cover you can get and it’s the absolute minimum required by law to drive on UK roads. The name says it all, really. It’s designed to protect other people—the ‘third parties’—if you’re responsible for an accident.

In short, it covers their costs, not yours .

The Legal Minimum for UK Drivers

The term ‘third party’ might sound like insurance jargon but it’s actually quite simple when you break it down. In any claim, there are three key players.

Here’s who’s who:

- The First Party: That’s you, the person who holds the insurance policy.

- The Second Party: This is your insurance company.

- The Third Party: This is everyone else involved in an accident you’ve caused. It could be another driver, their passengers, a cyclist, a pedestrian or even the owner of a property you’ve damaged.

Think of a Third Party Only (TPO) policy as a financial safety net for everyone except you. If you’re at fault, your insurer (the second party) steps in to pay for the third party’s costs. This includes things like repairs to their car, medical expenses for their injuries or even the cost of rebuilding a garden wall you crashed into.

But here’s the crucial part: this policy offers no financial help whatsoever for damage to your own car or for any injuries you get. That’s the fundamental trade-off. You’re legally on the road but you’re on your own if your car needs fixing. You can discover more insights about third party only car insurance and what it means legally.

A common myth is that because it’s the most basic cover, it must be the cheapest. That’s not always true. Insurers often link this type of policy with higher-risk drivers which can sometimes push the premiums up. It's always worth comparing all your options.

What Exactly Does Third Party Insurance Cover?

When people talk about third party car insurance, what they're really talking about is your financial safety net. If you cause an accident, this is the cover that steps in to handle your legal liability for the harm done to others. Without it, you could be facing claims that are financially devastating.

So, what does it actually pay for? It boils down to two key areas. First up, it covers injuries to other people. Think other drivers, their passengers, pedestrians or a cyclist – anyone who gets hurt because of the accident.

Second, it covers damage to other people's property. Say you misjudge a turn and scrape a neighbour's parked car or reverse into someone's garden wall. Your third party policy is designed to pay for those repairs so you aren't left footing the bill yourself.

Who Counts as a "Third Party"?

This is where things can get a bit confusing but it’s an important detail. The passengers in your own car are also considered 'third parties' under your policy.

That means if you have an accident and it’s your fault, their medical costs or any personal injury claims they make are covered. This is a fundamental part of UK road safety law, making sure innocent people have a way to get compensation for injuries they didn't cause.

The core idea is simple: a third party policy deals with your liability to everyone else. It pays for their injuries and their property damage but it doesn't offer a penny of protection for you or your own car.

Real-World Scenarios and Limitations

Let's put this into practice. Imagine you're found to be at fault for a collision. Here’s what a basic third party policy would typically cover:

- The repair costs for the other person’s vehicle.

- Medical bills for a pedestrian you accidentally injured.

- Compensation claims from the passengers who were in the other car.

- The cost of repairing public property , like a damaged bus stop or traffic sign.

What it won’t cover is just as important to grasp. The policy will not pay for:

- Repairs to your own car.

- Your losses if your car is stolen or damaged by fire.

- Any compensation for your own injuries.

All of those costs will have to come out of your own pocket.

The Hidden Costs of Choosing Minimum Cover

It’s one of the biggest myths in car insurance: that third party cover is always the cheapest option. While it certainly offers the least protection, that doesn't automatically mean it comes with the smallest price tag. In fact, many drivers are surprised to learn that a comprehensive policy can sometimes work out to be significantly less expensive.

So, what's going on here? This strange pricing paradox comes down to how insurers calculate risk.

When you opt for only the legal minimum cover, some insurers see that as a red flag. They might associate this choice with drivers who are statistically more likely to make a claim—think younger motorists or those with less experience behind the wheel. The logic is that a driver who isn't concerned about protecting their own vehicle might just be less careful overall.

As a result, the insurer bumps up the price of the third party policy to balance out this perceived risk.

The Real Cost of Perceived Risk

The data often backs up this counter-intuitive trend. For instance, the average annual premium for a third-party only policy can hover around £581 . That’s surprisingly higher than many comprehensive policies, which average closer to £447 a year.

This highlights a crucial lesson for anyone shopping for car insurance: never assume less cover equals a lower cost. It’s essential to compare quotes for all levels of insurance to find out what’s genuinely the best value for your situation.

The ultimate risk of minimum cover goes far beyond the premium. If your insurer rejects a claim due to a policy exclusion or suspected fraud, you are left completely exposed. With no cover for your own vehicle, a denied claim following an at-fault accident means you bear the full cost of repairs or replacement which could be thousands of pounds.

This is exactly why proving the facts of any incident is so important. When a dispute arises, solid evidence is your only real defence against footing a massive bill yourself. It’s also wise to understand the common reasons why your insurance company might refuse to pay a claim before you find yourself in that stressful position.

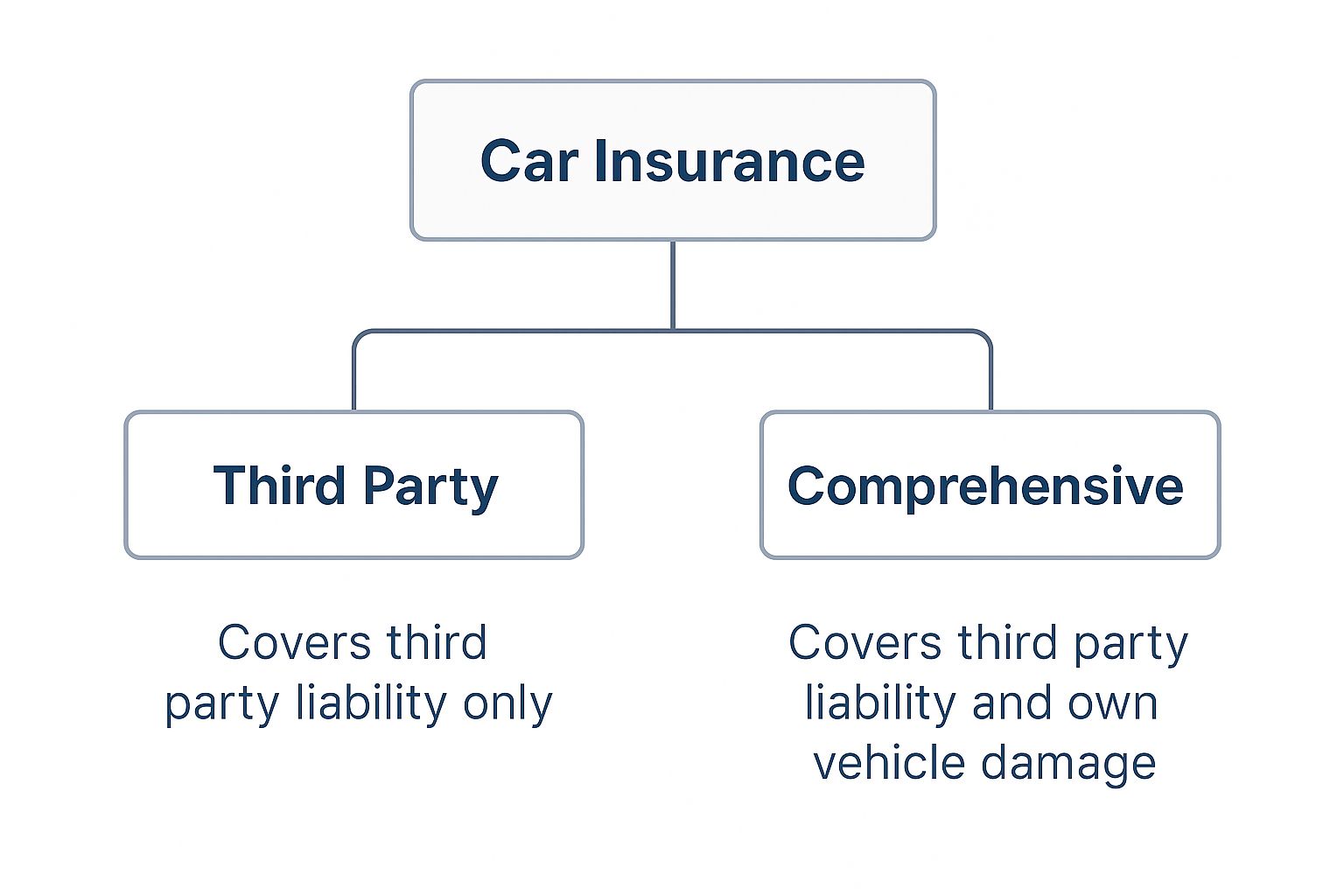

Comparing UK Car Insurance Levels

Choosing the right car insurance in the UK can feel like navigating a minefield but it really boils down to understanding three distinct levels of protection. Each one builds on the last, offering progressively more cover for different situations. Getting your head around these differences is the key to matching a policy to your actual needs and budget.

UK Car Insurance Levels: A Direct Comparison

Let's break down what each type of policy actually covers. Think of it as a ladder – you start at the bottom with the legal minimum and can climb higher for more comprehensive protection.

At the most basic level, you have Third Party Only (TPO) insurance. This is the absolute legal minimum you need to drive in the UK. It’s a one-way street: it only covers your liability for any injury or damage you cause to other people or their property. Crucially, it leaves you and your own car completely uncovered.

One step up is Third Party, Fire and Theft (TPFT) . This policy includes everything from TPO but adds two significant protections: it will pay out if your car is stolen or damaged by fire. It’s a popular middle-ground option but remember, it still offers zero protection if your car is damaged in an accident that was your fault.

Finally, we have Fully Comprehensive insurance. As the name suggests, this provides the highest level of protection available. It bundles in all the cover from the lower tiers and, most importantly, covers damage to your own vehicle – even if an accident was your fault.

To see exactly how these policies stack up against common risks, this table breaks down what is typically covered under each.

| Coverage Type | Third Party Only (TPO) | Third Party, Fire & Theft (TPFT) | Fully Comprehensive |

|---|---|---|---|

| Damage/Injury to Others | ✔️ | ✔️ | ✔️ |

| Damage to Your Car (Your Fault) | ❌ | ❌ | ✔️ |

| Theft of Your Car | ❌ | ✔️ | ✔️ |

| Damage by Fire | ❌ | ✔️ | ✔️ |

| Windscreen Repair | ❌ | ❌ | ✔️ |

This side-by-side comparison makes the gaps in the lower-level policies crystal clear. While a basic third party policy gets you on the road legally, it leaves you financially exposed to the full cost of repairing or replacing your own vehicle after an at-fault incident. That's a risk worth thinking about carefully.

Why Proving Your Claim Matters

When you file an insurance claim, it's not just a simple request for money. It’s the start of a formal process and like any formal process, it needs proof. Your insurer has to check every single detail to make sure the claim is legitimate. This scrutiny is essential to combat insurance fraud, a costly problem that affects the entire UK car insurance market.

Just how big is it? We’re talking about a sector valued at around £17 billion and it's set to grow even more. You can read the full research on the UK car insurance market to get a sense of its incredible scale.

In a market this huge, insurance fraud is a constant and expensive headache for the industry and for honest policyholders. It's far from a victimless crime—in fact, its effects are felt by every single driver on the road.

The Ripple Effect of Insurance Fraud

Fraudulent claims can be anything from someone exaggerating a genuine injury to staging deliberate accidents, often called 'crash for cash' schemes. These are elaborate scams designed to fool insurers into paying out for invented injuries and vehicle damage. While insurance companies invest heavily in detection, the scale of the problem is vast.

The cost of this deception is staggering. The Association of British Insurers (ABI) has found that undetected general insurance fraud costs the industry more than £1 billion every year. That enormous loss doesn't just vanish; it gets passed directly on to honest customers like you through higher premiums.

What that means is a slice of your annual premium is actually covering the cost of someone else's dishonesty. The more fraud there is, the higher premiums climb for everyone.

This is exactly why it’s so important to gather solid, provable evidence after a genuine accident. Being meticulous helps your claim go smoothly and protects you from disputes. Using modern tools to provide crystal-clear evidence, like how geo-location data strengthens insurance claims , is a game-changer.

By proving your claim is legitimate, you're not just securing your own payout. You’re also doing your part to create a fairer system that helps keep costs down for every policyholder.

When Is Third Party Insurance The Right Choice?

So, after digging into the risks and weird pricing, you might be wondering if third-party insurance is ever a good idea. Despite its big limitations, there are a few situations where this basic cover is actually a logical, cost-effective choice. It just comes down to being really honest about your car and your circumstances.

The classic case is for an older car with a very low market value. If the cost of a comprehensive policy is getting close to—or even more than—what the car is actually worth, paying for that extra protection just doesn’t add up financially. Why insure something for more than you’d get back?

Making a Decision Based on Facts, Not Feelings

Another scenario is the second car that hardly ever sees the light of day. If you've got a vehicle that mostly just sits in the garage, getting the minimum legal cover might feel like the right move to keep it on the road without racking up high annual costs.

Ultimately, this decision has to be based on hard evidence, not just a gut feeling. Before you commit, you absolutely must run the numbers on these key factors:

- Your car’s current market value and what it would likely cost to repair.

- Your own financial situation – could you afford to replace the car out of pocket if it were written off?

- A direct comparison of quotes across all three levels of cover.

The only way to know for sure is to compare prices. Never assume third party insurance will be the cheapest. You have to get quotes for every single option to find out what offers the best value for your specific situation.

Frequently Asked Questions

Can I Drive Someone Else's Car on My Policy?

It’s a common question but the answer is almost always no. A standard third party policy is designed to cover you for one specific vehicle—the one named in your documents.

The ability to drive other cars, often called the 'DOC' extension, is a feature sometimes included with comprehensive policies. It's exceptionally rare to find it on a basic third party only plan. You should always assume you're not covered and double-check your policy wording. Getting this wrong could mean you’re driving uninsured which carries serious legal penalties.

Why Is Third Party Insurance So Expensive for Young Drivers?

This often comes as a shock but it boils down to statistical risk. Insurers set their prices based on data and unfortunately, younger or less experienced drivers are statistically more likely to be involved in an accident.

Because third party policies are sometimes favoured by drivers who are seen as higher-risk, this combination can lead to surprisingly steep quotes. An insurer might see a young driver with only basic cover as a bigger financial gamble than an experienced motorist with a comprehensive policy and the price will reflect that. For more answers to common insurance queries, take a look at our general frequently asked questions.

What Happens if My Car Is a Write-Off?

This is where the reality of third party insurance really hits home. If you have this level of cover and you’re at fault for an accident, your policy will only pay for the other person's vehicle and property damage.

It provides no cover at all for your own car. If your vehicle is damaged beyond repair and declared a 'write-off', you will have to cover the entire cost of replacing it out of your own pocket. This is easily the biggest financial risk you take when choosing this minimal level of insurance.

At Proova , we believe in the power of proof. Our app simplifies the process of documenting your assets before an incident occurs, making any future claims process faster and fairer. Secure your peace of mind and protect against fraud by visiting https://www.proova.com.