Subrogation in Insurance: A Complete UK Guide

At its heart, subrogation in insurance is a legal principle that allows your insurer to step in and pursue the third party responsible for your loss. It's the formal process of recovering the money they paid out for your claim from the person or company legally at fault.

Why Subrogation Is a Cornerstone of Fair Insurance

Let's use a simple example. Imagine a delivery driver misjudges a turn and reverses straight into your garden wall. You file a claim, and your home insurer quickly pays for the repairs. But the story doesn’t end there. Subrogation gives your insurer the right to "step into your shoes" and claim that money back from the delivery company.

This fundamental process does two things. First, it stops you from being paid twice for the same damage—once from your insurer and again from the party who caused it. More importantly, it ensures financial responsibility lands where it should.

The Role of Provability in Subrogation Claims

A subrogation claim lives or dies on provability . An insurer cannot simply send an invoice; they have to build a rock-solid case backed by undeniable evidence. This is where the real work begins. The insurer’s recovery team must painstakingly gather proof that shows:

- A specific third party was legally responsible for the loss.

- The amount paid out on the claim is a direct result of the damage they caused.

- The policyholder has met all their obligations under the policy.

Without hard evidence—such as accident reports, witness statements, or an expert's analysis—the claim will not get very far. This focus on provability is a critical check and balance within the system, preventing baseless allegations.

Fighting Insurance Fraud and Managing Costs

Subrogation is also one of the industry's best weapons against insurance fraud, a crime that ultimately costs us all. By pursuing the responsible parties, insurers ensure the costs of negligence or malicious acts are not unfairly spread across all policyholders. When a claim is proven to be someone else's fault, holding them to account stops that loss from being absorbed into the general pot of claims data, which would otherwise drive up premiums.

This recovery mechanism is vital for the financial health of the entire insurance industry. Every pound an insurer successfully recovers through subrogation is a pound that doesn't need to be offset by increasing premiums for everyone else. Fraudulent and exaggerated claims cost the UK economy billions each year, and subrogation is a key tool in this fight.

Ultimately, this process helps all of us. By making sure those who cause losses are the ones who pay for them, subrogation in insurance helps keep the market fair and affordable. It reinforces accountability, actively discourages fraud, and directly contributes to the stability of the premiums we all pay.

The Legal Foundations of Subrogation in the UK

Subrogation is not just some internal process created by insurance companies. It is a powerful legal right, deeply woven into the fabric of UK law. It draws its strength from two main sources: long-standing common law principles and the specific wording baked into almost every insurance policy. This dual foundation gives insurers the legal clout they need to pursue at-fault third parties, keeping the whole system fair and financially sound.

At its core, subrogation in insurance is built on the principle of indemnity. This is a fundamental legal concept that says your insurance should put you back in the same financial position you were in before a loss — but never in a better one. You should not profit from a disaster. Subrogation is how this principle is put into practice, preventing a situation where you are paid by your insurer and then sue the responsible person for the same damages.

By letting the insurer effectively “step into your shoes,” the law ensures the loss is only paid for once, and the bill ultimately lands with the party that caused the problem in the first place.

The Principle of Indemnity in Action

Let's make this real. Imagine a plumber’s shoddy work leads to a major water leak, ruining your kitchen. Your insurer steps in and pays £10,000 for the repairs. Thanks to the principle of indemnity, you have been made whole again.

But what if you could then turn around and sue the plumber for another £10,000 ? You would have made a profit from the incident. Subrogation slams the door on that possibility. It transfers your right to sue over to your insurer, who can then pursue the plumber to recover the £10,000 they paid out. It is a simple mechanism that ensures fairness while holding the negligent party accountable.

How Court Rulings Shape Modern Subrogation

The rules of subrogation are not set in stone. They are constantly being refined by new court rulings that bring clarity to tricky, modern-day scenarios. These decisions have a huge impact on how insurers build and carry out their recovery strategies, especially when liability is disputed or multiple insurance policies overlap.

A landmark ruling in the case of Watford Community Housing Trust v Arthur J Gallagher Insurance Brokers Limited shed crucial light on how multiple policies should interact. The claimant had three overlapping policies with combined limits over £11 million but only managed to recover £6 million after the insurers disputed how to respond. The court ruled that policyholders can claim their full loss under any combination of their policies up to the total limit, and they get to choose the order.

This decision massively boosts a policyholder's indemnity rights and directly shapes how insurers must coordinate their subrogation in insurance efforts when several policies are in play. You can explore the full implications of recent legal shifts in the UK reinsurance market to get a deeper understanding.

This kind of judicial clarity is essential. It reinforces that subrogation is not just a contractual agreement but a legally enforceable right that UK courts will uphold, ensuring the financial integrity of the insurance system.

The continuous fine-tuning of these legal principles is vital. It gives insurers a clear framework to manage claims, combat insurance fraud, and keep costs stable across the industry. Without this solid legal backing, the ability to recover costs would be crippled, and the financial burden would inevitably be passed on to all policyholders in the form of higher premiums. These legal foundations are the very bedrock supporting the entire mechanism of fair and affordable insurance for everyone.

How the Subrogation Process Actually Works

So, how does subrogation actually play out in the real world? It is a journey that starts the moment a loss occurs and does not end until the money is recovered. Think of it as the insurance industry's way of balancing the books, making sure the person or party actually responsible for the damage is the one who ultimately pays.

It all kicks off when you, the policyholder, make a claim. It could be for anything – a car crash that was not your fault, a leak from the flat above, or damage to your business property. Your first move is always to let your insurer know and document everything you can.

From there, your insurer steps in to investigate. Once they have confirmed your claim is covered under your policy, they will pay you out. Their goal is to get you back to the financial position you were in before the incident happened. This initial payout is the trigger that gives them the right to then pursue the at-fault party.

Identifying Liability and Building a Case

After settling up with you, the insurer's recovery team gets to work. Their sole focus is now on the third party. The big question they need to answer is: can we legally hold someone else responsible for this loss? This is where provability becomes everything.

You cannot build a subrogation claim on a hunch. It needs a rock-solid foundation of evidence that points the finger squarely at the responsible party. This means a thorough, almost forensic, investigation to gather every scrap of proof.

What kind of evidence are we talking about?

- Official Reports: Things like police accident reports or fire brigade logs are golden. They provide an objective, authoritative account of what happened.

- Witness Statements: Independent eyewitnesses can be incredibly powerful. Their first-hand accounts can confirm the sequence of events and pinpoint negligence.

- Expert Assessments: For more complex claims, like a faulty product causing a fire, reports from specialist engineers or surveyors are non-negotiable. They establish the 'how' and 'why'.

- Photographic and Video Evidence: A picture really is worth a thousand words. Clear photos or videos of the damage and the scene provide undeniable proof.

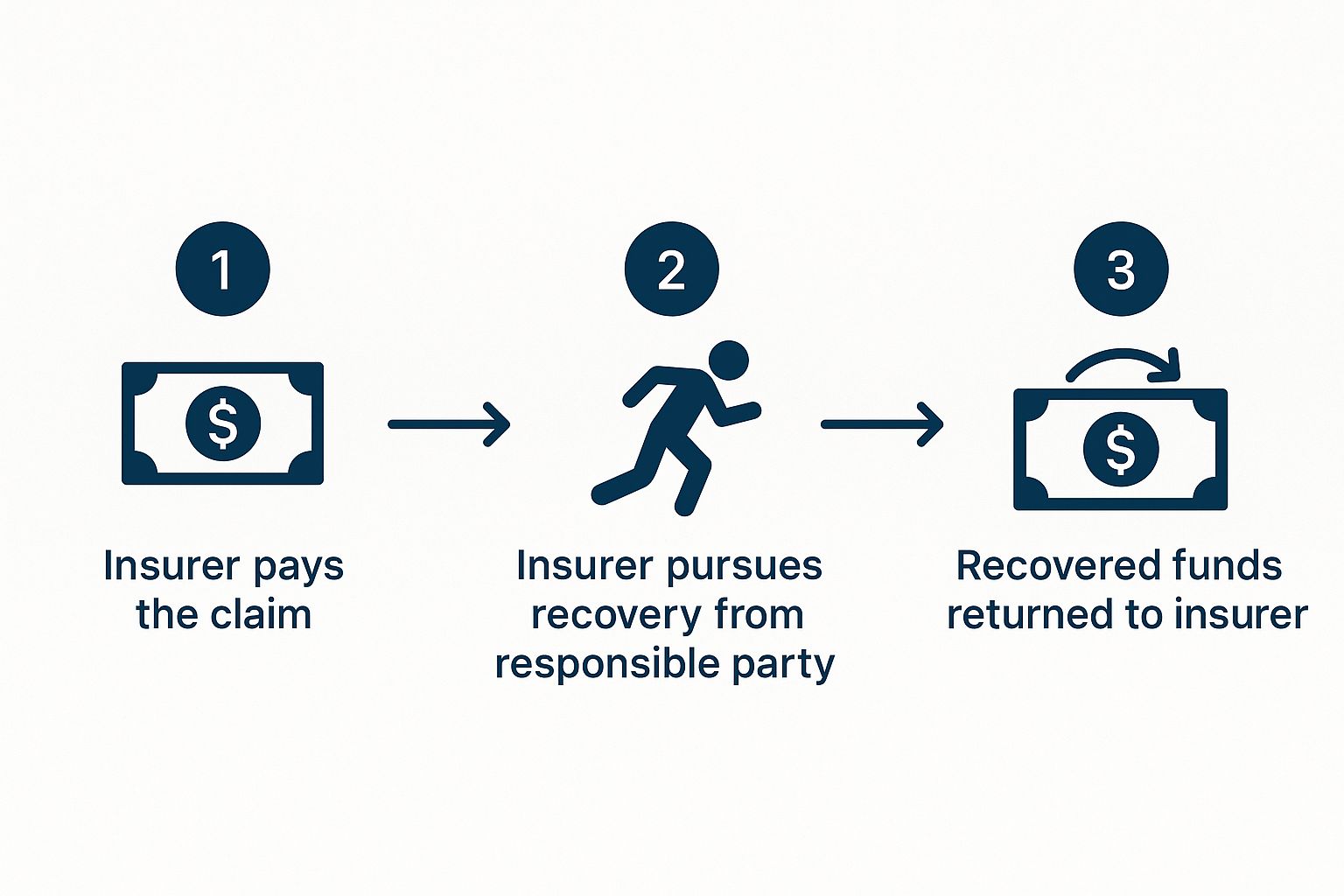

This simple graphic breaks down the core workflow.

As you can see, the process is fundamentally about transferring financial responsibility back to where it belongs – with the party who caused the loss in the first place.

To give you a clearer picture, let’s break down the typical stages of a subrogation claim here in the UK.

Key Stages of the UK Subrogation Process

| Stage | Key Actions | Evidence Required |

|---|---|---|

| 1. Incident & Claim Filing | The policyholder reports the loss to their insurer immediately after it occurs. | Initial loss report, photos/videos from the scene, policy details. |

| 2. Investigation & Payout | The insurer assesses the claim, confirms cover, and pays the policyholder. | Adjuster’s report, repair estimates, proof of payment. |

| 3. Liability Assessment | The insurer's recovery team investigates to identify the at-fault third party. | Police/fire reports, witness statements, expert opinions. |

| 4. Case Building | All evidence is compiled into a comprehensive file to prove liability. | A complete evidence pack, including invoices for all costs incurred. |

| 5. Demand & Negotiation | The insurer sends a formal demand to the third party (or their insurer). | Letter of demand, full evidence file, detailed breakdown of costs. |

| 6. Settlement or Litigation | Parties negotiate a settlement. If unsuccessful, legal action may be initiated. | Settlement agreements, court filings (if applicable). |

| 7. Recovery of Funds | The insurer receives payment from the at-fault party, concluding the process. | Proof of payment transfer, final file closure documentation. |

This table maps out the methodical path from that first phone call to the final bank transfer, highlighting just how evidence-driven the entire process is.

Pursuing Recovery and Final Resolution

Once the case is built, the insurer formally kicks off the recovery process. This usually starts with a formal letter of demand sent to the at-fault party or their insurance company. This letter lays it all out: what happened, why they are liable, and exactly how much is being claimed.

This is often the point where negotiations begin. The other side's insurer will scrutinise the evidence, and they might push back, disputing liability or questioning the costs. A bit of back-and-forth is pretty standard here.

The strength of that initial evidence file is absolutely critical during these talks. A well-documented, provable claim is far more likely to get settled quickly, saving everyone the time and money of a drawn-out legal fight.

If negotiations hit a brick wall, the insurer might decide to take legal action. It is not a decision taken lightly, as it means weighing the potential recovery against the hefty costs and unpredictability of going to court. The good news is that most claims are settled long before they ever see a courtroom, especially when the evidence is clear.

The final piece of the puzzle is getting the money back. Once the third party or their insurer pays up, the subrogation process is complete. This successful recovery does more than just reimburse the insurer; it is a key part of the fight against insurance fraud and helps keep premiums stable for all of us. By making sure the bill lands with the responsible party, subrogation in insurance reinforces a fair and sustainable market.

How Subrogation Impacts Your Insurance Premiums

Subrogation might sound like a bit of legal jargon buried in your policy documents, but it is actually a critical financial process that has a direct impact on the premiums you pay. At its heart, it is a powerful cost-control tool for the entire insurance industry. It works to ensure the financial fallout from a loss lands on the party who caused it, not on innocent policyholders.

Think of it like this: insurers have a large pot of money to pay out claims. Every time they settle a claim, that pot gets smaller. When they successfully recover those funds through subrogation, they are essentially refilling the pot. This simple act of recovering the money means the insurer does not have to factor that loss into its calculations for future premiums.

A Crucial Defence Against Fraud and Rising Costs

Beyond just recovering money, subrogation in insurance is a vital defence against fraud. By carefully investigating claims to figure out who is truly liable, insurers build a system of accountability. This process stops negligent parties from simply walking away, leaving the insurer—and by extension, all its customers—to pick up the tab. It also makes it much harder for fraudulent or exaggerated claims to slip through when a third party is clearly at fault.

Every successful recovery is a win for fair pricing. It stops the costs of negligence from being spread across the entire customer base. Without it, the rising tide of claims costs—inflated by both genuine losses and criminal fraud—would inevitably push premiums higher for everyone, no matter how careful they are.

The connection is direct: the more effective an insurer is at subrogation, the more stable it can keep its premiums. It is the industry’s primary method for clawing back funds that would otherwise be lost, helping to maintain financial balance in an unpredictable world.

The Staggering Scale of Property Claims

To get a real sense of the impact, just look at the sheer scale of property claims in the UK. These claims make up a huge chunk of all insurance payouts, and their costs are constantly climbing, often driven by things like severe weather.

For example, in just one recent three-month period, UK property insurers paid out a massive £1.6 billion in claims—a 7% jump from the previous quarter. Weather-related damage alone was responsible for £322 million of that total, with the average household claim reaching £6,200 . Subrogation gives insurers a direct path to recoup some of these enormous payouts from liable third parties, such as a careless contractor or the manufacturer of a faulty washing machine.

The Role of Provability in Keeping Premiums Fair

The success of this whole system hangs on one critical factor: provability . An insurer cannot recover a penny without solid, indisputable proof that a third party was liable. This is why having a robust evidence trail from the very start of a claim is absolutely essential. Good proof not only builds a watertight case for the insurer but also speeds up the recovery process, making it far more cost-effective.

The more provable claims are, the more money insurers can recover. This recovered income directly offsets the need to raise premiums, creating a more stable and affordable insurance market for us all. Modern tools and technologies are continually improving this process, and you can read more about the role of technology in reducing insurance claims costs in our detailed guide.

Ultimately, effective subrogation is a win-win. It holds negligent parties accountable while rewarding responsible policyholders with fairer premiums.

Why Proving a Subrogation Claim Is So Challenging

Anyone who thinks recovering funds through subrogation is a simple bit of admin is in for a rude awakening. In reality, it is a complex, often brutal process, littered with obstacles that can stop a recovery attempt dead in its tracks. The path from paying a policyholder's claim to clawing that money back from a liable third party is rarely a straight line.

The single biggest hurdle? The burden of proof. It is not enough for an insurer to believe a third party is at fault; they have to prove it with concrete, legally sound evidence. If the at-fault party or their insurer digs their heels in and denies liability, the claim instantly becomes a battle of evidence. A weak or incomplete evidence file is the number one reason subrogation claims fall apart.

This is precisely why building a rock-solid, evidence-based case from the moment a loss is reported is so critical. Without it, the chances of a successful recovery plummet. You can see just how crucial this is by reading our article on how real-time evidence changes everything from theft to payout .

Common Hurdles in the Recovery Process

Beyond the core challenge of gathering evidence, several other major hurdles can complicate or completely derail a subrogation claim. Each one requires careful navigation and a strategic approach from the insurer’s recovery team.

Some of the most frequent roadblocks include:

- Uninsured or Underinsured Defendants: Pursuing an individual or business with no insurance or insufficient cover to pay the claim can be a pointless exercise. Even if you win a court judgment, actually collecting the money can prove impossible.

- Strict Statutes of Limitations: Every type of claim has a legal deadline for starting legal action. Miss this window, even by a single day, and the right to recover is lost for good.

- High Costs of Litigation: Taking a disputed claim to court is an expensive, time-consuming affair. Insurers are constantly weighing the potential recovery amount against the legal fees and resources needed to win the case.

The decision to pursue a claim is never automatic. It is a calculated business decision where the potential return must justify the investment of time, resources, and legal expenditure. For smaller claims, the costs of pursuit can sometimes outweigh the amount being recovered.

The Influence of Market Conditions

The wider economic climate also plays a huge part in an insurer's appetite for pursuing subrogation. The competitiveness of the UK insurance market, for example, directly affects an insurer’s capacity and willingness to chase recoveries, especially on the more challenging or lower-value cases.

Recent market analysis, for instance, shows that UK insurance rates have softened across most lines. This soft market, driven by high insurer capacity, squeezes profitability. In response, insurers are often more motivated to pursue subrogation vigorously to reclaim funds and bolster their bottom line. The economic landscape creates a dynamic where the strategic importance of successful subrogation can rise and fall.

Ultimately, these challenges paint a realistic picture of why subrogation is so demanding. It is a discipline that requires a sharp blend of legal expertise, meticulous investigation, and commercial savvy to get right. Every successful recovery is a hard-won victory that helps fight insurance fraud and contributes to a fairer, more stable insurance market for everyone.

Real-World Examples of Subrogation in Action

Theory is one thing, but to really grasp subrogation, you need to see it play out in the real world. These tangible scenarios show how insurers connect the dots from an initial payout to a final recovery, reinforcing just how crucial provability and accountability are in this industry.

Ultimately, each example shows that subrogation in insurance is not just a paper-shuffling exercise to get money back. It is about upholding fairness, fighting fraud, and keeping the entire system financially stable for every policyholder.

The Negligent Contractor and the Commercial Fire

Picture a small business owner watching their retail shop go up in smoke. After the fire brigade and the insurer’s own investigators sift through the wreckage, they trace the cause back to faulty wiring installed by a contractor during a recent renovation.

The owner’s commercial property insurer acts fast, paying out £150,000 to cover repairs and the costs of business interruption. Once the policyholder is looked after, the insurer's subrogation team steps in. They methodically build a case against the contractor, using the official fire report and an independent electrical engineer’s assessment as undeniable proof of negligence. A formal demand is then sent to the contractor’s public liability insurer who, facing a mountain of evidence, agrees to settle. This successful recovery not only refills the insurer's pot but ensures the negligent party’s policy carries the financial weight, not the wider pool of innocent business owners.

The Multi-Car Pile-Up

A classic motor insurance scenario: a multi-car pile-up on the motorway. A driver, distracted by their phone, ploughs into the back of a stationary car, triggering a chain reaction that damages four other vehicles. It is chaos.

Multiple insurers are now involved, each paying out for their own policyholder’s repairs. But the story does not end there. The insurer for the first car that was hit kicks off a subrogation claim against the at-fault driver. Using police reports, dashcam footage, and witness statements, they establish liability beyond doubt. Their successful recovery reimburses them and also sets a clear precedent for the other affected insurers to follow, creating a coordinated effort to hold the responsible driver accountable. This process is also vital in dismantling organised fraud, a topic we explore in our guide on 'Crash for Cash' scams.

These coordinated recovery efforts are vital. They prevent at-fault parties from escaping their financial obligations and stop the costs of dangerous driving from being absorbed by responsible motorists through increased premiums.

The Faulty Washing Machine Flood

Imagine coming home from holiday to find your kitchen underwater. The culprit? A brand-new washing machine that catastrophically failed, continuing to fill until a hose burst and unleashed chaos.

The homeowner’s insurer covers the extensive water damage, paying £25,000 for a new kitchen and flooring repairs. The subrogation journey starts immediately. The insurer secures the faulty appliance and sends it for expert analysis. A product liability specialist confirms a manufacturing defect was the sole cause of the failure. Armed with this definitive proof, the insurer pursues the washing machine manufacturer. Faced with the evidence, the manufacturer’s own insurance company accepts liability and reimburses the homeowner's insurer in full. This action does not just recover the claim cost; it holds manufacturers accountable for the safety of their products.

Common Questions About Subrogation

Even when you grasp the basic process, it is natural to have questions about how insurance subrogation actually affects you. Let's face it, navigating your responsibilities after a claim can feel confusing, so let’s clear up some of the most common queries with straightforward answers.

Most of these questions come down to the policyholder's role in the process and, of course, the financial outcome. Getting to grips with what is expected of you is the key to a smooth claims journey.

Must I Cooperate with My Insurer?

Yes, absolutely. Think of your insurance policy as a contract – because it is one. Buried in the terms and conditions, you will almost certainly find a cooperation clause . This clause legally obliges you to help your insurer in their efforts to recover costs from a third party.

What does this cooperation look like in practice? It could mean a few things:

- Providing all the documents and evidence you have.

- Giving a formal statement or testimony if matters head towards court.

- Appearing in court if your presence is required.

Failing to cooperate is a breach of your policy, and that could put your cover at risk. Your assistance is genuinely vital for building a solid case and making sure the at-fault party is held accountable.

What Happens if the Recovery Is More Than My Claim?

This is a great question, and the answer really highlights the fairness of the system. Your insurer is only legally allowed to recover the exact amount they paid out to you for the loss. Not a penny more.

If the total amount recovered also includes your uninsured losses—which is most often your policy excess—that portion of the money comes straight back to you. The insurer cannot profit from subrogation; the goal is simply to be made whole again.

This ensures you benefit, too, by recovering out-of-pocket costs like your excess once the liable party pays up.

Can I Sue the At-Fault Party Myself?

Technically, the right to sue the at-fault party belongs to you… until your insurer pays your claim. Once that payment lands in your account, your right to sue is typically transferred to them under the principle of subrogation.

Trying to pursue the at-fault party on your own after your insurer has paid you could seriously interfere with their recovery strategy and might even violate your policy terms. It is always best to talk to your insurer before taking any independent action. They have the legal standing and the resources to manage the process properly, ensuring all costs are recovered, which ultimately helps keep premium costs down for everyone.

At Proova , we provide the tools to build an undeniable, provable record of ownership from day one, making the claims and subrogation process faster and more secure. Simplify your insurance journey by visiting https://www.proova.com.