A Guide to Commercial Auto Liability Coverage

Think of commercial auto liability coverage as your business's financial bodyguard on the road. It's not just a good idea but a legal must-have in the UK. This cover steps in to handle the costs if a company vehicle injures someone or damages their property, stopping a single accident from turning into a full-blown financial disaster for your business.

The Financial Shield for Your Business Fleet

Picture this: one of your vans is involved in a pile-up on the motorway. Without the right insurance, the financial fallout could be catastrophic. The bill for medical care, legal fees and vehicle repairs can mount up alarmingly fast, putting your entire operation at risk. This is precisely where commercial auto liability coverage proves its worth, acting as an essential safety net.

This insurance is legally required for any vehicle being used for business. It ensures that if one of your drivers is at fault for an accident, your company isn't left holding the bag for the costs. Your policy is designed to manage these potentially crippling expenses. Staying on top of the specific commercial auto insurance requirements for your type of business is absolutely crucial for compliance.

The Two Pillars of Liability Protection

At its heart, this coverage stands on two main pillars, both designed to shield your business from claims made by others. Getting your head around these is key to understanding the policy's value.

- Bodily Injury Liability: This is the part of the policy that deals with the human cost of an accident. It covers expenses related to injuries—or even fatalities—that your driver causes to other people, whether they're pedestrians or in another car. This can include everything from medical bills and lost wages to legal defence costs if you're sued.

- Property Damage Liability: This piece handles the cost of fixing or replacing someone else's property that your vehicle has damaged. Most of the time this means another car but it could just as easily be a garden wall, a shop front or a fence.

With the rise of fraudulent 'crash for cash' scams, having solid liability cover has never been more vital. It gives your insurer the power to investigate and fight back against suspicious claims, protecting not only your business but also the wider public from the rising premiums caused by insurance fraud.

This liability protection is the bedrock of any commercial vehicle policy. Every day your vehicles are out on the road, your business assets are exposed. The sheer potential for one mishap to cause immense financial harm makes this coverage an absolute non-negotiable for any responsible business owner.

Why This Coverage Is a Business Essential

It's easy to think of commercial vehicle insurance as just another box to tick, something the law says you must have. But the real reason you need solid liability cover runs much deeper—it's about keeping your business afloat when things go wrong.

Picture this: one of your delivery vans is involved in a collision during rush hour. The initial concern is getting the van repaired but the financial fallout can quickly snowball. If someone is injured, your business could be on the hook for their medical bills, long-term rehabilitation and even their lost wages. Toss in the legal fees to defend your company and you’re suddenly looking at a bill that could easily climb into tens, if not hundreds, of thousands of pounds.

This isn't just a worst-case scenario; it's a real-world risk that businesses across the UK face every day. A strong liability policy is your financial shield, designed to absorb these potentially crippling costs so you can keep your doors open.

The Growing Problem of Insurance Fraud

On top of genuine accidents, there's a more sinister threat that every company with vehicles on the road needs to be aware of: organised insurance fraud. We're not talking about someone slightly exaggerating a claim. These are calculated, criminal schemes designed to steal money from insurers—and ultimately, from all of us.

One of the most common and damaging scams is the 'crash for cash' scheme. Criminals will deliberately cause an accident with an innocent driver and they often target commercial vehicles because they assume the business has good insurance. They might slam on their brakes for no apparent reason or wave your driver out of a junction only to speed up and crash into them.

The entire event is staged to make your driver look like they were at fault. This then opens the door to a flood of fraudulent claims, such as:

- Inflated repair costs for their vehicle.

- Bogus injury claims from multiple "passengers" who weren't even in the car.

- Outrageous bills for vehicle recovery and storage from companies they're in cahoots with.

These schemes are far from victimless. They are a direct cause of rising insurance costs for every honest business owner, as insurers have to increase premiums across the board to cover the millions lost to fraudulent payouts. This fraud costs the industry and honest policyholders an estimated £1 billion a year.

Your Policy Is Your Best Defence

This is where your insurance policy proves its worth beyond just paying for legitimate claims. It’s also your first line of defence against scams and unfair allegations. When a suspicious incident happens, your insurer brings its expertise and resources to the table to investigate what really happened.

They have teams dedicated to spotting red flags, challenging inconsistent stories and fighting fraudulent claims in court. Without that backing, your business is left exposed and could be forced to pay out for an accident you didn't cause. Establishing the provable facts of a claim is a vital, and often forgotten, part of what you're paying for.

The UK's business insurance market is vast and liability claims are a major financial risk for companies of all sizes. You can explore more data on UK business insurance risks to see the full picture. In this environment, having robust liability cover isn't just a good idea—it's essential protection.

Understanding What Your Policy Actually Covers

When you get a commercial auto liability policy, it’s crucial to know what you’re actually paying for. It's not about protecting your own vehicles; it's about covering the damage your vehicles might cause to others. Think of it as a financial shield for your business when an accident happens.

At its heart, this coverage is split into two key areas.

First, you have Bodily Injury Liability . This is all about the people. If one of your drivers is at fault in an accident, this part of the policy steps in to cover the costs for anyone who gets hurt. We’re talking about medical bills, rehabilitation expenses and even lost wages if they can’t work. In a worst-case scenario, it also handles legal defence costs if your business is sued.

The second part is Property Damage Liability . This one is more straightforward—it pays to repair or replace someone else’s property that your vehicle damaged. Most of the time, this means another car but it could just as easily be a garden wall, a shopfront or a lamppost.

Combined Single Limit vs Split Limits

The way your policy pays out will be structured in one of two ways: either as a Combined Single Limit (CSL) or a Split Limit. It sounds technical but the difference is pretty simple.

A CSL policy gives you one big pot of money to cover everything in a single accident, mixing both bodily injury and property damage claims together. A Split Limit policy, on the other hand, carves up your total cover into separate pots for different types of damage.

- Combined Single Limit (CSL): This offers a single, flexible pool of funds. A £1 million CSL policy, for example, means you have up to £1 million to settle all claims from one incident, whether it's for injuries, property damage or a combination of both.

- Split Limits: These policies are more compartmentalised. You might see a policy described as 50/100/25 . This translates to £50,000 for any single person's injuries, a £100,000 total for all injuries in the accident and a separate £25,000 for property damage.

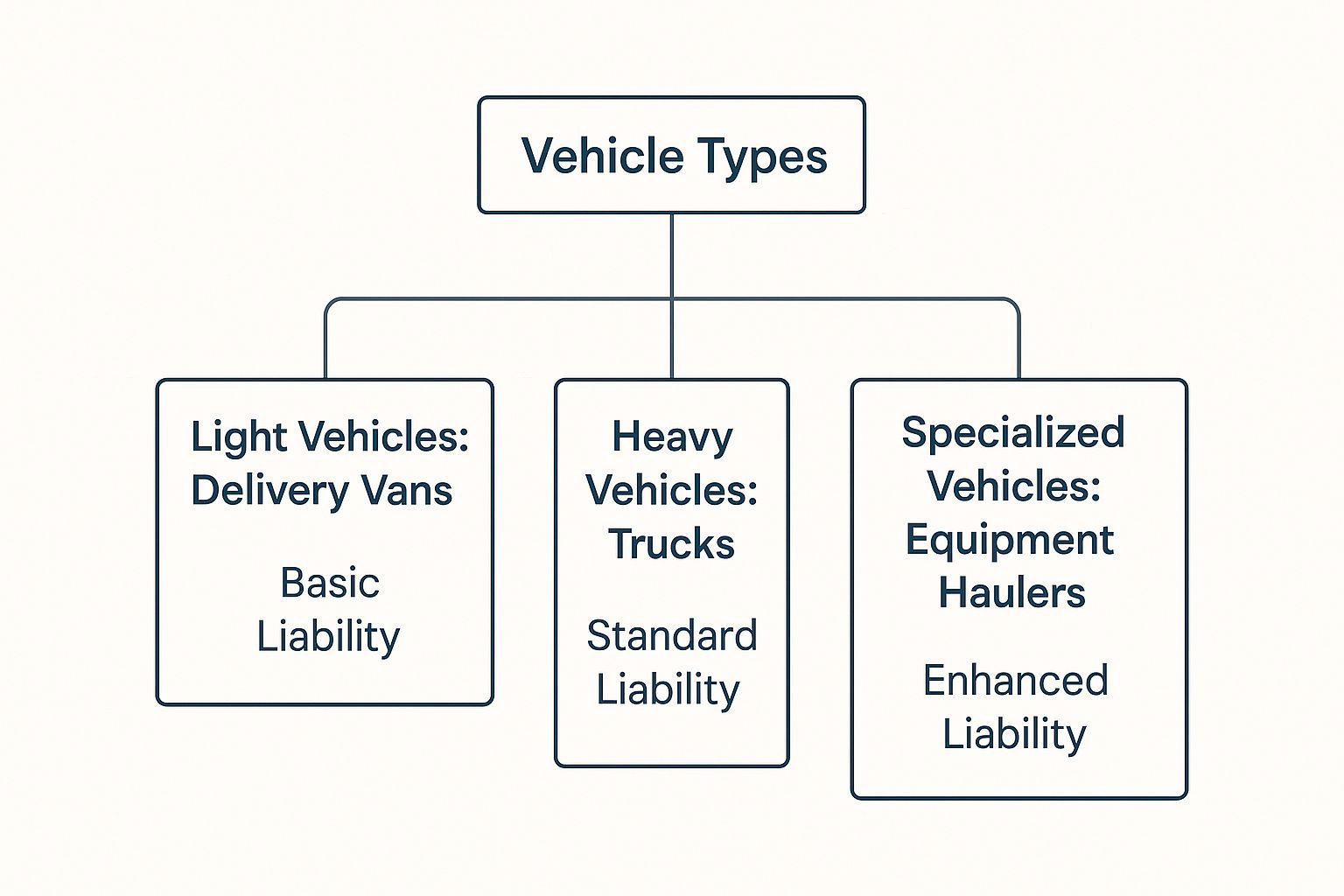

The right structure for your business often comes down to the types of vehicles you run. Heavier, larger vehicles carry a much higher risk of causing significant damage, which means they need more robust cover.

As you can see, the bigger the vehicle, the greater the potential for a very expensive accident and the higher the liability limits need to be.

What Is Not Covered

Knowing what your policy doesn't cover is just as important as knowing what it does. A standard liability policy has very clear boundaries and making assumptions can be a costly error.

The table below gives a quick overview of what's generally included in a standard liability policy versus what you'll likely need to arrange separately.

Commercial Auto Liability Coverage at a Glance

| Coverage Aspect | Typically Included | Typically Excluded (Requires Other Cover) |

|---|---|---|

| Damage to Others | Bodily injuries to third parties (pedestrians, other drivers). | Damage to your own company vehicles. |

| Property of Others | Repair or replacement of other people's vehicles and property. | Damage to cargo or goods you are transporting. |

| Legal Costs | Legal defence fees if your company is sued after an accident. | Employee injuries (covered by workers' compensation). |

| Medical Expenses | Medical treatment and rehabilitation for injured third parties. | Theft of your vehicle or its contents. |

The key takeaway is that liability insurance is outward-facing; it protects others from the actions of your drivers. Protecting your own business assets requires different types of cover.

One of the most common and dangerous misconceptions is that commercial liability covers damage to your own fleet or theft of tools from a van. It doesn't. For that, you'd need Collision, Comprehensive or specific Goods in Transit insurance. Relying only on liability leaves your own assets completely exposed.

Even with the right policies in place, insurers can sometimes dispute a claim. It’s worth understanding why your insurance company might refuse a claim and what your options are. The best defence is a good offence: read your policy documents carefully and talk through any potential gaps with your broker to make sure your business is properly protected.

How Your Insurance Premiums Are Calculated

Figuring out the price of commercial auto liability coverage isn't a case of an insurer just picking a number out of thin air. It’s a detailed process of risk assessment, where they build a unique risk profile for your business to predict how likely you are to make a claim.

Naturally, the process starts with your vehicles. Insurers look at the make, model, age and value of every vehicle in your fleet. It’s simple, really: a massive heavy goods vehicle can cause significantly more damage in a crash than a small delivery van, so its premium will reflect that higher potential cost.

But it’s not just about the vehicle itself; how you use it is a massive factor. A long-haul lorry clocking up hundreds of miles a day is exposed to far more risk than a local florist's van doing short, infrequent drops. Where you operate matters, too. Navigating busy city centres day in, day out is considered much riskier than sticking to quiet rural lanes.

The Human Element and Your History

The people behind the wheel are every bit as important as the vehicles they’re driving. Insurers will want to see the driving records for all your staff. A history of accidents or a licence full of penalty points is a major red flag and will almost certainly push your premium up.

Your company’s own claims history gets a thorough review as well. If you’ve made frequent claims in the past, an insurer will see you as a higher risk and price your policy accordingly. On the flip side, a clean record is one of your best assets when it comes to negotiating a better price.

Proactive risk management is your best strategy for controlling costs. By fitting vehicles with telematics and dashcams or investing in regular driver training, you provide concrete evidence of your commitment to safety. This provable data can lead to significant premium reductions.

Taking these steps shows insurers you're serious about safety and it can be invaluable when it comes to defending your business against fraudulent or overblown claims.

Wider Industry Pressures on Your Premium

It’s important to realise that your premium isn't just about you. It's also shaped by bigger economic forces that affect the entire insurance industry. Think about the soaring repair costs for modern vehicles packed with expensive sensors and electronics or the ongoing battle against insurance fraud—both of these push prices up for everyone.

This creates a really complex pricing picture. For example, recent commercial insurance rate trends in the UK have shown rates for passenger transport going up, while fierce competition has actually driven down prices for some van fleets. It just goes to show how detailed the analysis gets.

Ultimately, the premium you pay is a combination of your specific business risks and these much broader, industry-wide challenges.

Navigating the Claims Process After an Incident

When one of your vehicles is involved in an accident, the first few minutes are absolutely critical. What your driver does at the scene can make or break the entire claims process, protecting your business from unfair blame and helping your insurer shut down fraudulent claims.

The top priority, always, is safety. Check if anyone is hurt and call for emergency services immediately if needed. Once you know everyone is okay, the focus has to shift to gathering solid, factual information. This evidence is the foundation of your claim and your best defence.

For a great breakdown of what to do right away, this guide on the steps to take after a car accident is a fantastic resource. Giving your drivers a simple checklist can be a lifesaver in a high-stress situation.

Gathering Provable Evidence at the Scene

The strength of your claim comes down to the quality of the evidence you can provide. We live in a world of 'crash for cash' schemes and exaggerated claims, so relying on someone's memory just won't cut it. Your driver needs to become a fact-finder.

Their smartphone is their best tool. They should take photos and videos of everything from every conceivable angle—the position of the vehicles, the damage, the road conditions, nearby traffic signs, even the weather. If there are any independent witnesses, getting their contact details is like striking gold; their account of events can be pivotal.

Here’s a quick checklist of what to collect on the spot:

- Photos and Videos: Get wide shots of the whole scene, then close-ups of all damage to every vehicle involved.

- Other Party's Details: You'll need their name, address, phone number and their insurance company details.

- Witness Information: Grab the names and phone numbers of anyone who saw what happened.

- Official Report: If police are on the scene, make sure to get the officer's name, badge number and the incident reference number.

The Role of the Claims Adjuster and Technology

After you've reported the incident, your insurer will hand the case over to a claims adjuster. Their job is to dig into what happened, figure out who was at fault and determine how much the claim is worth. They'll be poring over every piece of evidence you've collected, which is why getting it right at the scene is so important.

The rise of insurance fraud costs the industry and its customers billions each year. Solid, verifiable evidence from the scene is the single most powerful tool an insurer has to refute a fraudulent claim, saving everyone money in the long run.

This is where technology really changes the game. Dashcams and telematics aren't just gadgets; they're your impartial witnesses. They provide an undeniable record of events, confirming speed, braking and the exact point of impact, leaving very little room for anyone to bend the truth.

This kind of hard evidence doesn't just protect you from blame. It also helps your insurer settle genuine claims far more quickly. Providing clear, indisputable proof from the get-go is key and it's amazing how technology helps brokers speed up claim resolutions and get you back to business faster.

The Future of Commercial Vehicle Insurance

The landscape for commercial auto liability coverage is shifting right under our feet and technology is firmly in the driver's seat. We're seeing a move away from traditional, static risk assessments. Insurers are now using artificial intelligence to dig into telematics data, giving them a real-time picture of how your fleet actually behaves on the road.

This means pricing is becoming fairer and far more accurate. Instead of just looking at basic factors like driver age or vehicle type, insurers can now base premiums on genuine driving habits.

This tech is also a game-changer when it comes to fighting insurance fraud. AI algorithms can sift through hours of dashcam footage in an instant, flagging the subtle signs of a staged 'crash for cash' scam that the human eye might miss. This not only protects your business from fraudulent claims but helps keep premiums down for everyone by weeding out dishonest players.

This innovation couldn't come at a better time. The UK’s commercial insurance market is on a steep growth trajectory, expected to swell to a value of USD 60.67 billion by 2033. This expansion is being driven by exactly these kinds of technological advancements and a growing awareness of complex business risks. You can get a deeper look into the expanding UK commercial insurance market on imarcgroup.com.

The biggest takeaway here is about empowerment. When you fit your vehicles with telematics and dashcams, you're doing more than just complying with policy suggestions. You're taking control of your own risk profile and creating a rock-solid, provable record of your commitment to safety.

In this new era, you have a direct hand in shaping your insurance costs. To learn more about where things are heading, have a look at our article on the future of insurance trends to watch.

Frequently Asked Questions

When it comes to commercial auto insurance, a few common questions pop up time and time again. Let's clear up some of the most frequent queries so you can make confident decisions for your business.

Can I Just Use My Personal Car Insurance for Work?

That’s a definite no-go for most situations. Your personal car policy is usually just for getting to and from a single place of work and for personal trips. Once you start using your vehicle for anything business-related, like visiting clients, making deliveries or running errands, you step outside what it’s designed to cover.

If you have an accident while driving for work, your personal insurer will almost certainly deny the claim. This could leave you personally on the hook for every penny of the damages, which could be financially devastating for you and your business.

What Is Hired and Non-Owned Auto Liability?

Think of these as essential add-ons that plug critical gaps in your main commercial auto policy. They cover vehicles that your business uses but doesn’t actually own.

- Hired Auto Cover: This kicks in when you rent, lease or borrow vehicles for your business. It protects you when you’re driving a vehicle that isn't formally listed on your policy.

- Non-Owned Auto Liability: This is hugely important. It covers your business if one of your employees uses their own car for a work-related task. For example, if they cause an accident while driving their personal vehicle to the bank for the company, this protects your business from being sued.

Without non-owned liability, a simple trip to the post office by an employee in their own car could expose your business to a massive lawsuit if they cause an accident along the way.

How Can We Lower Our Insurance Premiums?

The good news is you have more control over your premiums than you might think. Insurers love to see a business that actively manages its risk.

A few proven strategies include setting up a formal driver safety programme, keeping detailed records of regular vehicle maintenance and installing telematics or dashcams. These actions show you’re serious about safety.

Other practical steps include carefully vetting new drivers before you hire them and maintaining a clean claims history. You could also choose to pay a higher voluntary excess, which usually results in a lower premium.

At Proova , we believe in providing certainty. Our platform helps you create an indisputable record of your assets and their condition, which can strengthen your position during underwriting and speed up claims when the unexpected happens. Find out how Proova can help protect your business at https://www.proova.com.